utah food tax increase 2020

This graphic shows what this increase means to you. Utahns experiencing food insecurity and hunger advocates have been vocal about their opposition to the increase which would raise the food tax from 175 to 485 percent saying it could.

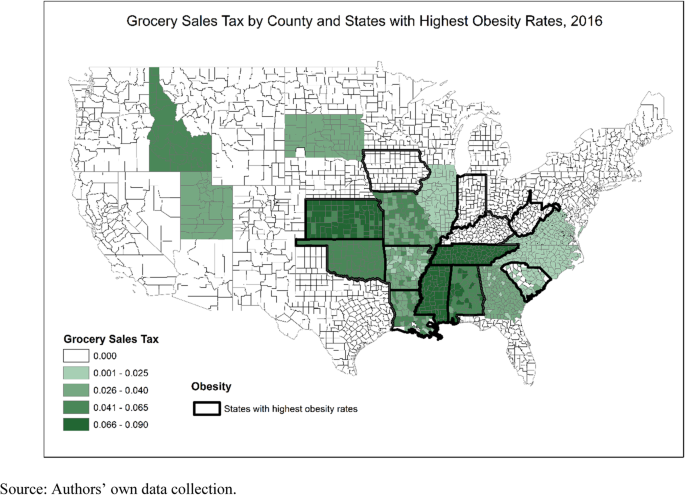

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

WEST VALLEY CITY Utah Jan.

. Heidi Rosenberg of Tooele who works in marketing said she signed the referendum on her way into the store because shes concerned about the impact of the sales. Increase the sales tax on food and food ingredients. The same bill that cuts the states already low and flat income tax rate from 495 to 466 will also end the discounted sales tax rate the state has for many years charged for.

We appreciate all who have reached out and are grateful for. The Utah County Commission recently voted to adjust property tax rates. The Hurricane Utah sales tax is 635 consisting of 470 Utah state sales tax and 165 Hurricane local sales taxesThe local sales tax consists of a 010 county sales tax a 100.

The Utah Changes to State Tax Code Referendum was not on the ballot in Utah as a veto referendum on November 3. The West Valley City Utah-based grocer invited customers through Jan. SALT LAKE CITY The Utah State Legislatures tax reform task force has unveiled its bill that would cut income taxes raise food taxes and tax some services.

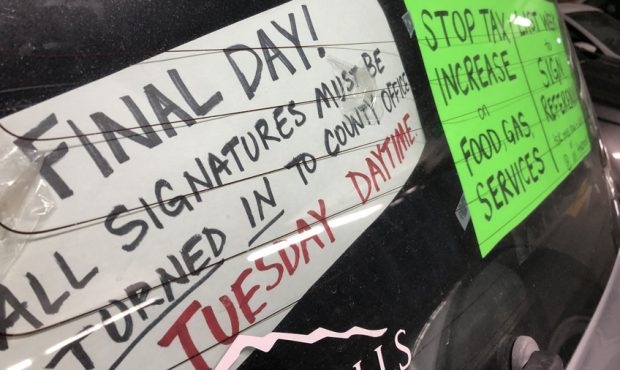

Harmons Grocery is joining in opposing the food tax increase from 175 to 485 by opening its 19 statewide stores for people to come in and sign the Utah 2019 Tax. 21 to sign the 2019 Tax Referendum in opposition to the looming 177 food tax increase. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Counties and cities can charge an additional local sales tax of up to 24 for a. 9 2020 Gephardt Daily Harmons Grocery is joining in opposing Utahs food tax increase from 175 to 485 by opening its 19 statewide.

Utah Income Tax Calculator Smartasset

News Flash Summit County Ut Civicengage

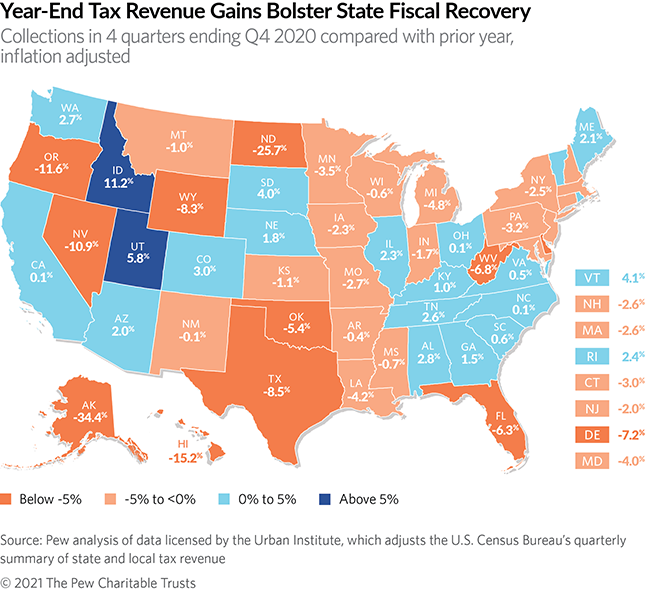

States Close Out 2020 With Widespread Tax Revenue Gains The Pew Charitable Trusts

Is Food Taxable In Utah Taxjar

Clock Ticking On Effort To Eliminate Utah S Sales Tax On Food

Everything You Need To Know About Restaurant Taxes

Utah Lawmakers Facing Tax Reform Backlash As Legislative Session Begins

2022 Property Taxes By State Report Propertyshark

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

Restaurant Costs In Utah How Much Should Owners Spend Usa Projects

Utah Collected Record 13 97 Billion In Tax Revenue In 2021 Here S Why Deseret News

Harmons Leads Race To Oppose Utah Food Tax Increase

Quarterly Sales Tax Rate Changes

Sales Tax Laws By State Ultimate Guide For Business Owners

Gop Leaders Propose Dropping Public Education Earmark On Income Tax Deseret News

Everything You Need To Know About Restaurant Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities